Bitcoin, Ethereum have more to go!

ONE44 Analytics where the analysis is concise and to the point

Our goal is to not only give you actionable information, but to help you understand why we think this is happening based on pure price analysis with Fibonacci retracements, that we believe are the underlying structure of all markets and Gann squares.

For the ONE44 Fibonacci rules and guidelines to help with this article, go here.

Charts are courtesy of Barchart.com

Bitcoin

Following up on the last post, the two highs to retrace back to are the ATH and the high before taking out the long term swing point. Using the high on 12/27/21, 37,950 is 23.6%, they have hit this level on Wednesday, Friday and today, if this is all it can rally the trend remains very negative and you can look for new lows and then the long term target of 61.8% at 28,000. Provided they get above 37,950 look for 42,400, this is 23.6% back to the ATH. The long term trend will not turn positive until 38.2% back the ATH is taken out, this is 47,500. Use the major Gann squares for support/resistance and targets once taken out.

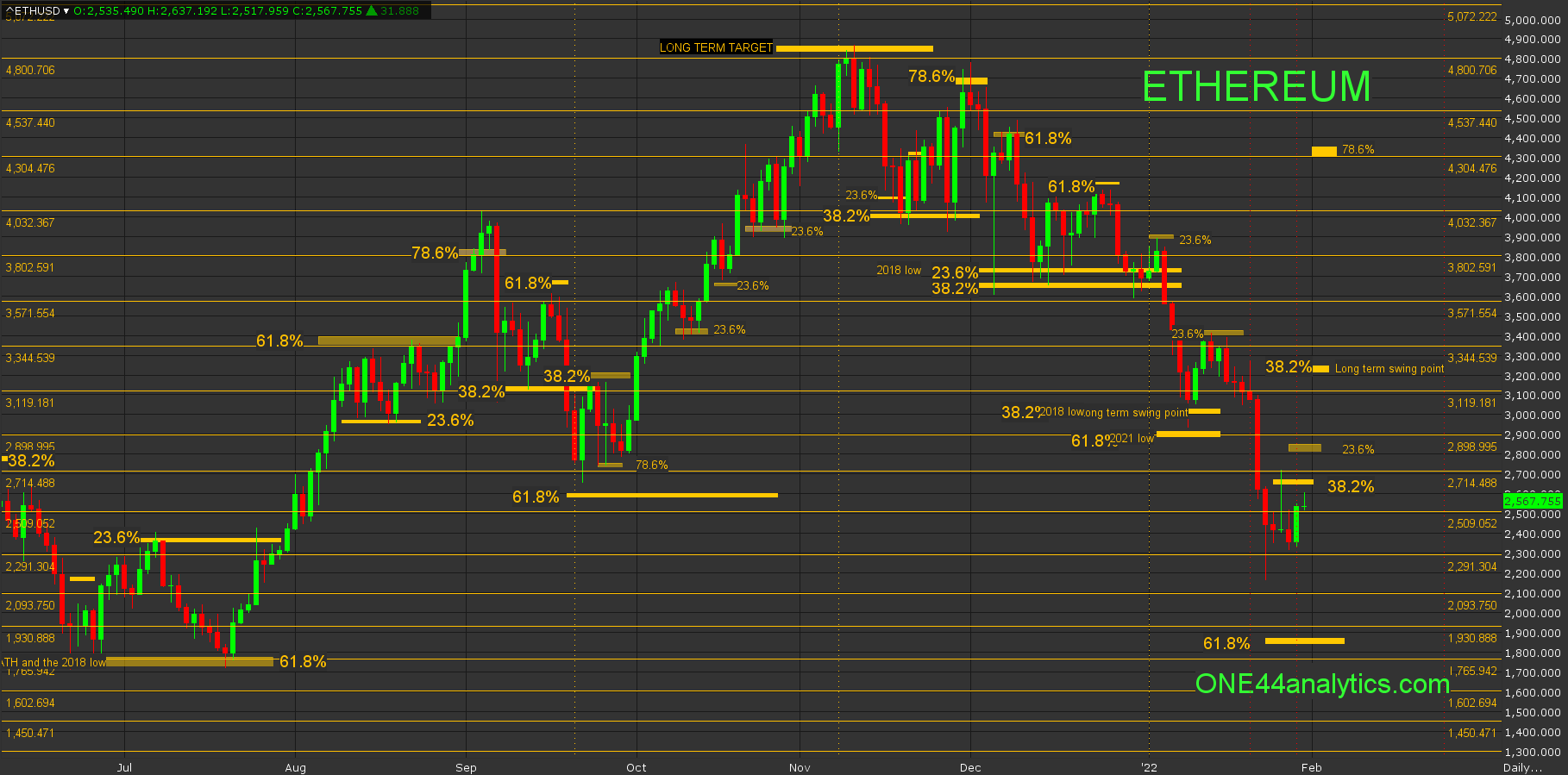

Ethereum

Using the high on 1/2/22 just before it took out the long term swing point, 38.2% is 2650.00, if this is all it can rally the trend remains very negative and you can look for new lows and then 61.8% of the ATH and 2018 low at 1850.00. Getting above 2650.00 should send it up to the new long term swing point at 3210.00, this is 38.2% back to the ATH. Here too, the major Gann squares are very good to trade around.

Sign up for our Free newsletter here.

If you are looking for option plays to go with the ONE44 levels, we highly recommend going to the Barchart webinar library where John Rowland has plenty of information on Option strategies.Here is one, Using the Long Strangle Options Strategy for Opportunity Trades

FULL RISK DISCLOSURE: Futures trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Commission Rule 4.41(b)(1)(I) hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under- or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. Past performance is not necessarily indicative of future results.