Bitcoin, Ethereum hit our long term targets

ONE44 Analytics where the analysis is concise and to the point

Our goal is to not only give you actionable information, but to help you understand why we think this is happening based on pure price analysis with Fibonacci retracements, that we believe are the underlying structure of all markets and Gann squares.

For the ONE44 Fibonacci rules and guidelines to help with this article, go here.

Charts are courtesy of Barchart.com

Cryptocurrencies

Bitcoin and Ethereum have hit our long term targets. For Bitcoin it was 67,700 and for Ethereum it was 4840.00. You can read about these targets in previous post.

After it fell just short of our long term target of 67,700 the setback was only able to get to 23.6% of the 6/22/21 low keeping the trend extremely positive and new highs followed. Today they have hit the 67,700 long term target and are currently trading at 66,850. Making a new high and failing to close above the previous high is not a good sign and a break from there can easily take it back to 38.2% of 6/22/21 low, this is 53,300 and just below it is a major Gann square at 52,800. Any setback from this area that only gets to 23.6% of the same move at 59,150 will keep the trend extremely positive and new highs should follow. The long term swing point is 43,450, this is 38.2% back to the 2018 low. Also in this area is a major Gann square at 44,100 that is also 61.8% back to the 6/22/21 low.

With a solid close above the 67,700 long term swing point, this level will become the short term swing point and you can look for the next few major Gann squares at 72,900, 78,520 and 84,050. Our next long term target once above 67,700 will be 89,770.

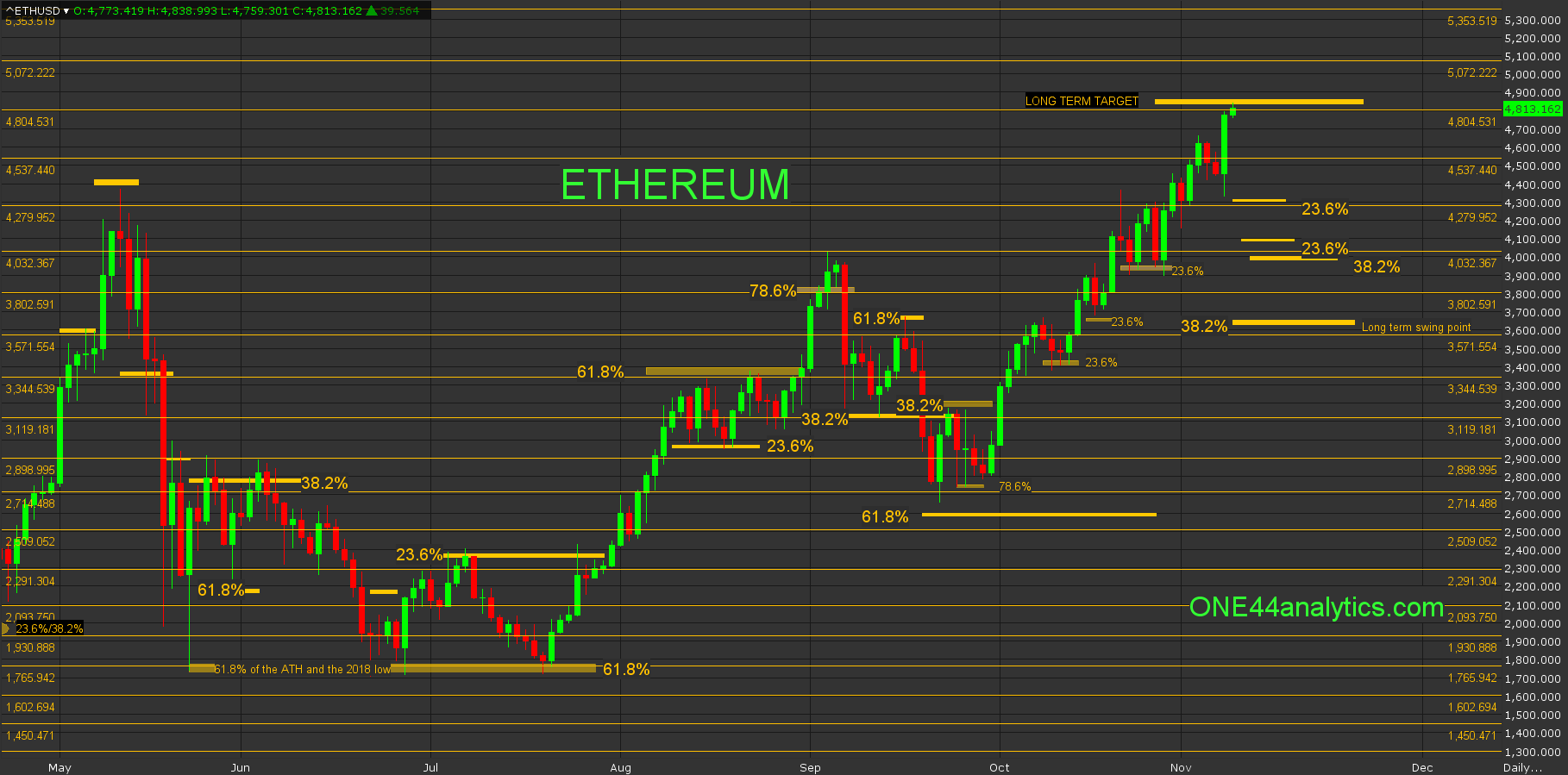

Ethereum (ETHE) (ETHUSD) (ETCUSD)

The overnight high was 4839.00 and the long term target is 4840.00, it is currently trading at 4800.00. As you can see on the chart below, all the previous setbacks held 23.6% of the 9/22/21 low showing just how strong this market was, so this is where we will look for support on any setback from 4840.00. This level is 4310.00 with a major Gann square just below at 4279.00. On a bigger setback from 4840.00 look for 23.6% to the 5/24/21 low, this is 4090.00. The long term swing point has moved up to 3650.00, this is 38.2% of the same move.

With a solid close above 4840.00, it will become the short term swing point and you can look for major Gann squares at 5072.00, 5353.00 and 5641.00. The new long term target with a close above 4840.00 will be 6270.00.

Sign up for our Free newsletter here.

FULL RISK DISCLOSURE: Futures trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Commission Rule 4.41(b)(1)(I) hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under- or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. Past performance is not necessarily indicative of future results.