Ethereum, caught between the Fib's

Ethereum

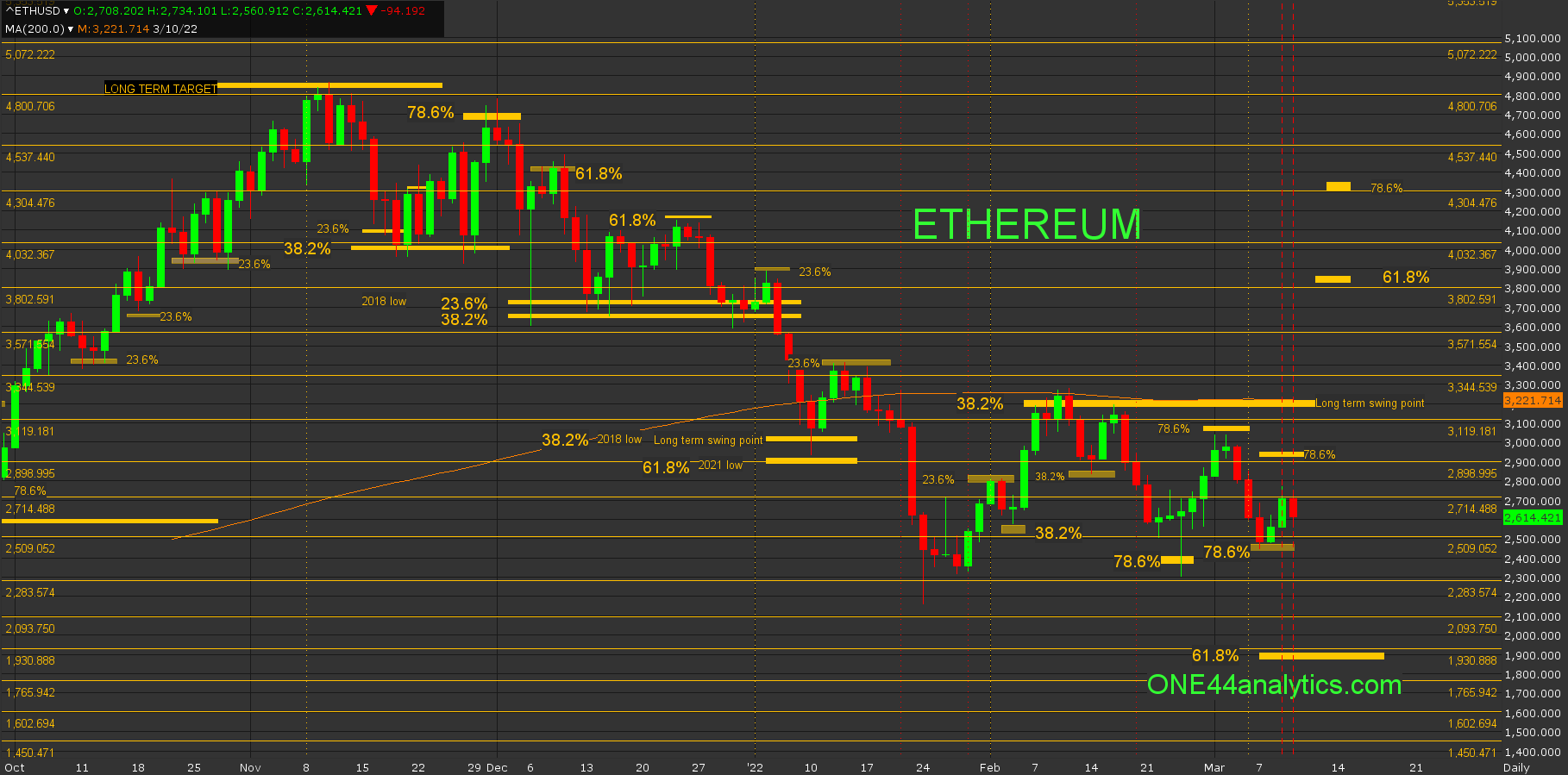

Ethereum remains long term negative. The high on 2/10/22 hit 38.2% back to the ATH and is our long term swing point. Being 38.2% we are looking for new lows, based on the ONE44 Fibonacci rules and guidelines. The target on making new lows is 61.8% of the ATH and 2020 low, this is 1900.00.

Short term

They are now caught between the 78.6% levels, the first is on 2/24/22 at 2405.00 and as the 78.6% rule states,

Any market that hits 78.6% should go 78.6% back the other way. This is also where a lot of Bull markets end and start.

The next rally completed the first part of the 78.6% rule and that is to look for 78.6% the other way. This was hit on 3/2/22 and the break from it hit 78.6% the other way on 3/7/22 at 2470.00. You can now look for 78.6% the other way at 2930.00. All of this keeps it in the trading range between the long term swing point and the 2163.00 low

Long term

We will be looking for the new low and 61.8% at 1900.00 until it takes out the long term swing point of 3180.00. When and if this level is taken out, the long term trend turns positive and we will look for 61.8% at 3850.00. You can use the major Gann squares on the chart marked with yellow horizontal lines for support and resistance in between the long term retracements.

For short term support and resistance use the Hourly chart below.

Sign up for our Free newsletter here.

FULL RISK DISCLOSURE: Futures trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Commission Rule 4.41(b)(1)(I) hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under- or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. Past performance is not necessarily indicative of future results.