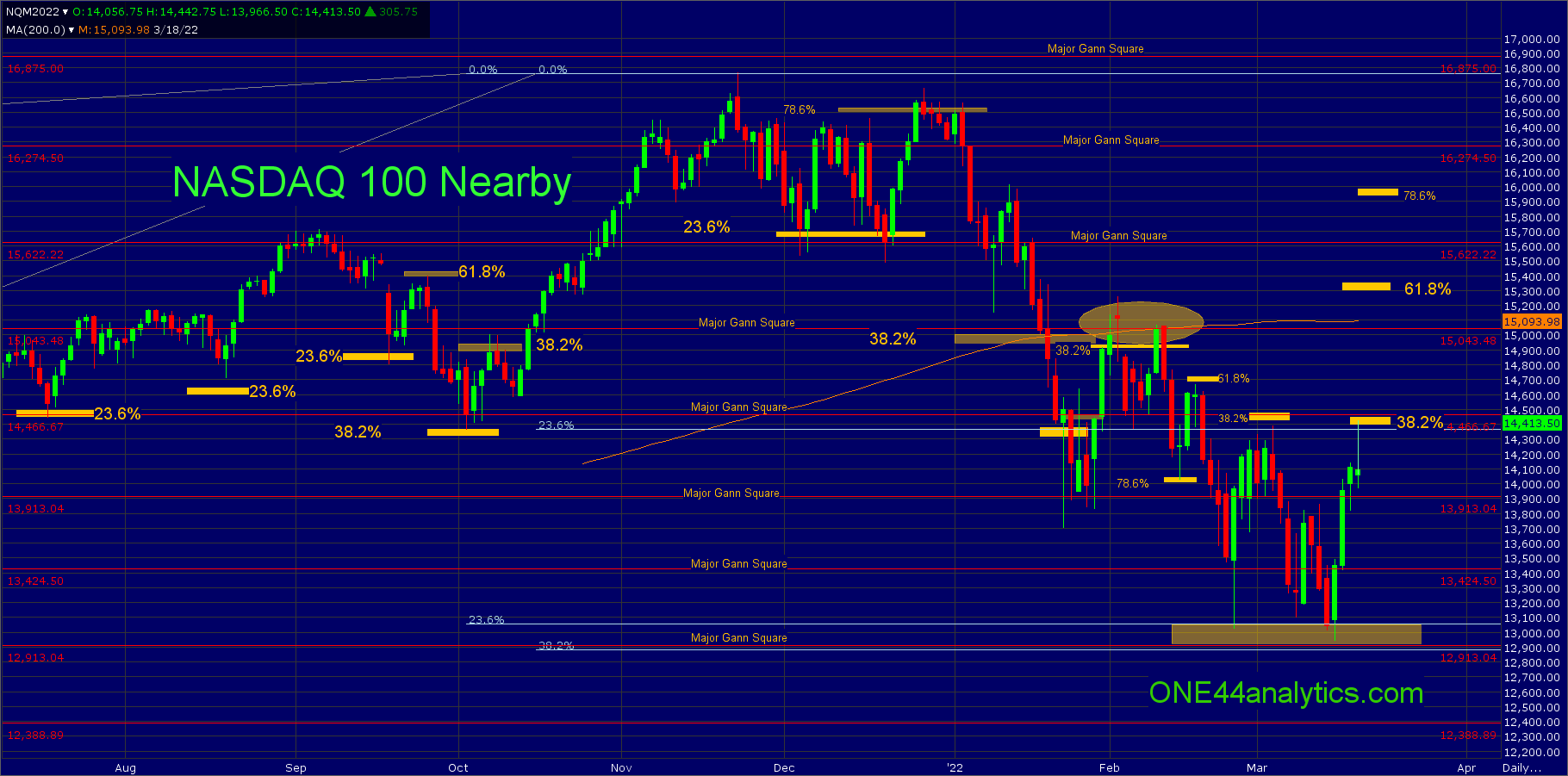

NASDAQ 100, 38.2% to 38.2%, now what?

NASDAQ 100

In our post on 2/26/22 This is what caused the massive turnaround in the NASDAQ 100 we showed what levels turned this market back up and what to look for. This is what we left you with,

A failure to get above 38.2% will keep the short term trend negative and you can look for new lows from it and a much lower target from there. That will be updated when and if there is a new low. Taking out 38.2% will be a positive sign and the short term target will be 61.8% at 15,350.

The high on 3/3/22 fell just short of 38.2% (14,400) back to the ATH from the major support area of 13,060 to 12,880. Failing to get above 38.2% kept the short term trend negative and you can now look for new lows.

In our next update on 3/8/22 NASDAQ 100, is this the start of a run up to 15,300 we mentioned what can send this market to 15,300.

So, by holding 78.6% on the break after retracing from 38.2% back to the ATH and knowing that this is where Bull runs can start, the next target would be 61.8% at 15,300. The 2/24/22 low also held a major area of support between 13,050 and 12,880 and this can send it back to test the ATH.

To Be Clear, as we always say, we watch all the retracements on every move to see just how weak, or strong the market is regardless of the long term target. We now know what is possible if it fails to make a new low here after setting back from 38.2% (14,450) and with a new low and close below 12,880 much lower prices are coming. Keep watching our website for the update if new lows are made.

It didn't hold 78.6% and it made a new low, however it did not close below 12,880 to give us targets that would have been much lower. What it did do when it made the new low is hit the bottom of the major support area of 13,050 to 12,880 and get right back above the previous low and this brings us to another part of the ONE44 38.2% rule.

When the market holds 38.2% and the reaction does not make a new high/low, or a slightly higher high/lower low, this is a sign the trend is changing and because they have already reacted from 38.2% you should look for 61.8% of that same move as well.

Following this rule after making only a slightly lower low, that was coming off of a 38.2% (14,400) retracement the next long term target is 61.8% at 15,300. It has already had over $1,400 rally after holding 12,880 in just 4 days and it closed at 38.2% (14,400) back to the ATH on Friday. Even though our long term target is 61.8% at 15,300 you still have to watch all the retracements to see just how strong, or weak the market is regardless of the long term target. A break from 14,400 can send it down to retest the lows. With a solid close above 14,400 and the 14,465 major Gann square look for the 61.8% target and by getting above 14,400 the short term trend turns positive and gets back in sync with the long term trend.

Sign up for our Free newsletter here

FULL RISK DISCLOSURE: Futures trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Commission Rule 4.41(b)(1)(I) hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under- or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. Past performance is not necessarily indicative of future results.