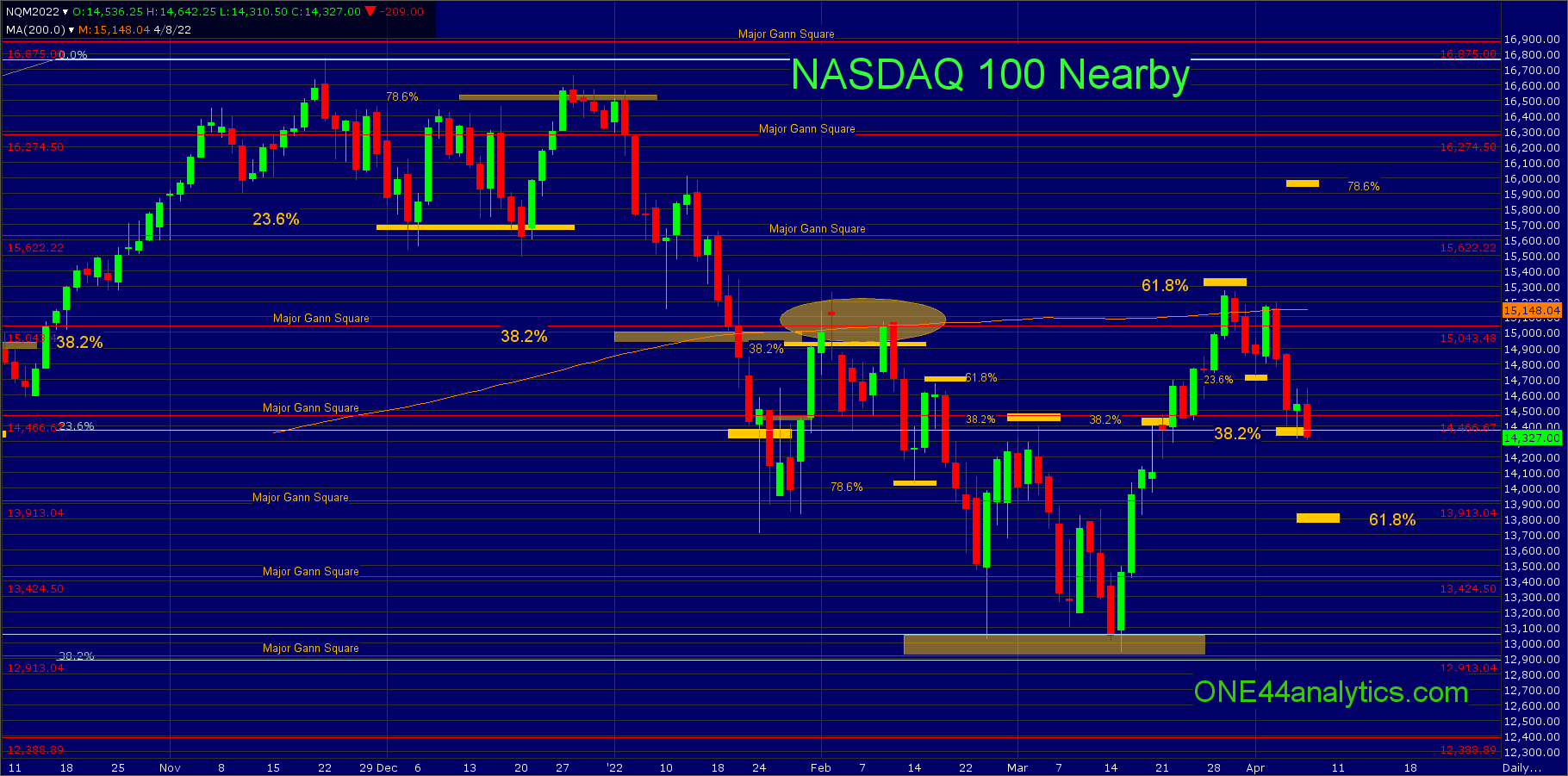

NASDAQ 100, 61.8% to 38.2%, it's all Fibonacci

NASDAQ 100

This is an ongoing update of the NASDAQ 100, our last one was on 4/2/22.

In it we left you with,

The break from 15,300 (61.8%) has now taken it to 23.6% of the recent rally at 14,725, if this is all it can break the trend remains extremely positive and you can look for a retest of the 15,268 high to start. The longer term target is still 61.8% at 13,850 based on the ONE44 61.8% rule. On a continued break from 61.8% look for 38.2% at 14,400, this is the short term swing point that it needs to hold to keep the trend positive. Below it, look for the 61.8% target. There are also major Gann squares that come in at 14,466 and 13,913; these are both right near 38.2% and 61.8% giving the areas added support.

The retest of the high on the rally from 23.6% at 14,725 failed to make a new high and also hit 78.6% back to the 3/29/22 high, this was also where the 200 day average was. The target on a break from 15,300 (61.8%) remains 61.8% the other way based on the ONE44 61.8% rule, this is 13,850. It has now hit the short term swing point that is 38.2% (14,400). Holding this area can send it up to the 15,043 major Gann square and failing to hold it should send it to 61.8% at 13,850 to complete the 61.8% target. Also keep an eye on the major Gann squares of 14,446 and 13,913 for support.

You can also use the Gann Law of Vibration chart for short term support and resistance, chart below.

Sign up for our Free newsletter here.