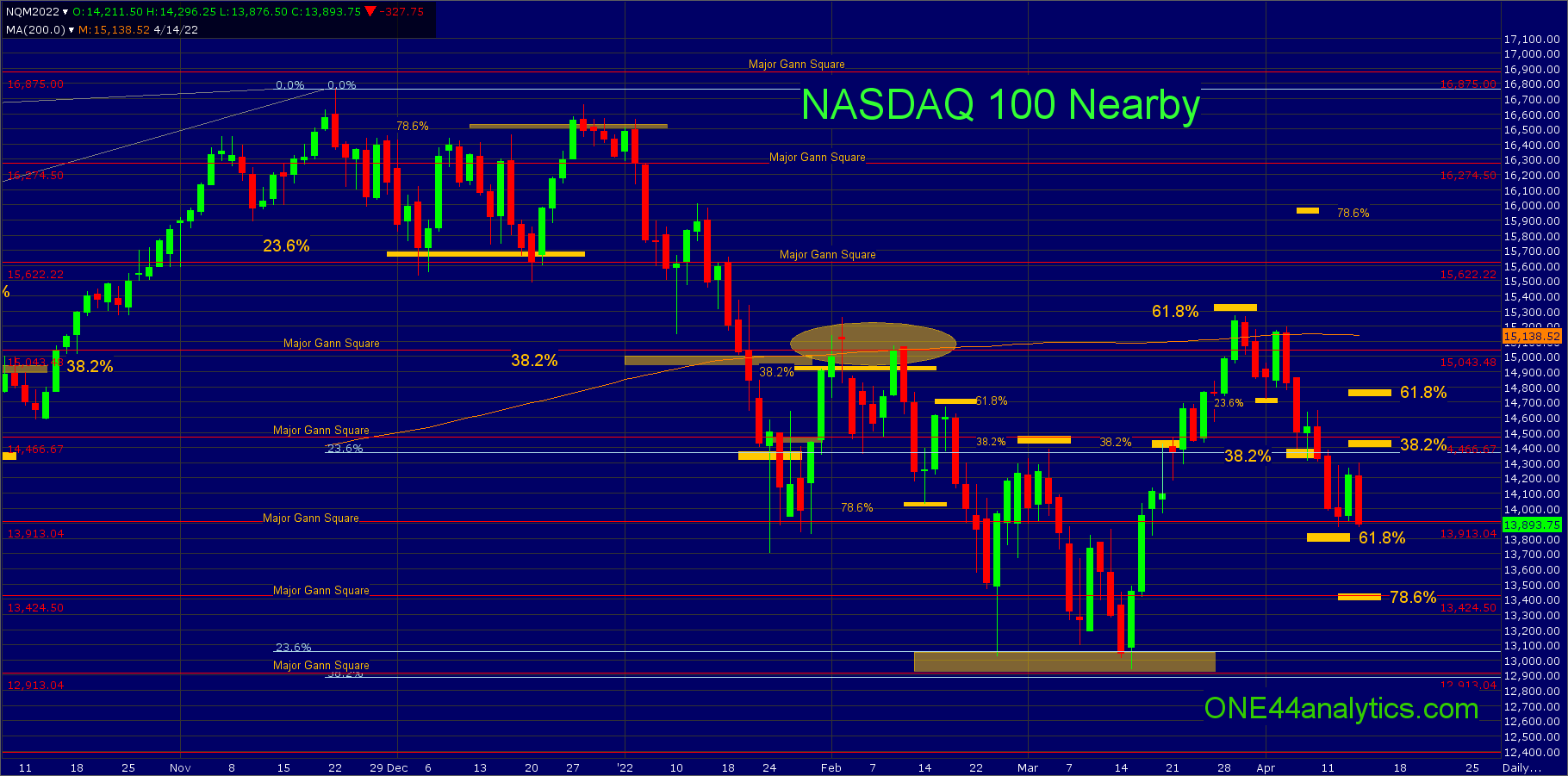

NASDAQ 100, from 15,300 to 13,850 following the ONE44 61.8% rule

NASDAQ 100

This is an ongoing update of the NASDAQ 100, our last one was on 4/9/22

We left you with this,

The retest of the high on the rally from 23.6% at 14,725 failed to make a new high and also hit 78.6% back to the 3/29/22 high, this was also where the 200 day average was. The target on a break from 15,300 (61.8%) remains 61.8% the other way based on the ONE44 61.8% rule, this is 13,850. It has now hit the short term swing point that is 38.2% (14,400). Holding this area can send it up to the 15,043 major Gann square and failing to hold it should send it to 61.8% at 13,850 to complete the 61.8% target. Also keep an eye on the major Gann squares of 14,446 and 13,913 for support.

As you can see on the chart the 38.2% level at 14,400 produced no bounce, it did hold the area for 3 days, but that was it. The break below 14,400 has now taken it to just short of 61.8% at 13,850, however this is close enough to complete the 61.8% target from 61.8% above based on the ONE44 Fibonacci 61.8% rule. It did hit the 13,913 major Gann square mentioned above and the rally from it was only able to get it up to 23.6% of the current break at 14,200, never a good sign. A rally from 13,850 can send it 61.8% the other way (61.8% rule) and this will be 14,700. Any rally from the current low that can not get above 38.2% at 14,400 keeps the short term trend negative and you should look for new lows. With a close below 13,850, look for 78.6% at 13,424, this is also a major Gann square.

You can also use the W. D. Gann Law of Vibration chart for short term support and resistance in between these longer term levels, chart below.

Sign up for our Free newsletter here.