The coming setback in Hogs and Cattle

Hogs

We are moving into the December contracts, so this is the last update for October.

From last update,

It hit 61.8% back at 96.85 today and there is a major Gann square at 97.10. Following the ONE44 61.8% rule, a break from 61.8% should send it back to 61.8% of where it just came from and this is 92.00.

Yesterday's high traded above 61.8% and the 97.10 major Gann square and we are now looking for a setback to 61.8% at 92.40 to complete the ONE44 61.8% rule target. Any break that can only go back 38.2% at 94.30 keeps the current leg very positive and you can look for new highs for the move. Failing to turn lower from the 97.10 major Gann square should send it to the next major Gann square at 100.30.

December Hogs

December is in a stronger position and the current rally took it just short of 78.6% at 89.26, this is also a major Gann square, however the potential for a break from 78.6% is bigger following the ONE44 78.5% rule and it could go 78.6% back from where it just came from, this is 82.97. A setback from 89.26 that can only go 38.2% back at 86.15 keeps the current leg up very positive and you can look for new highs. Not getting a turn lower from 89.26 should send it to the next major Gann square at 91.58.

October Cattle

From last update,

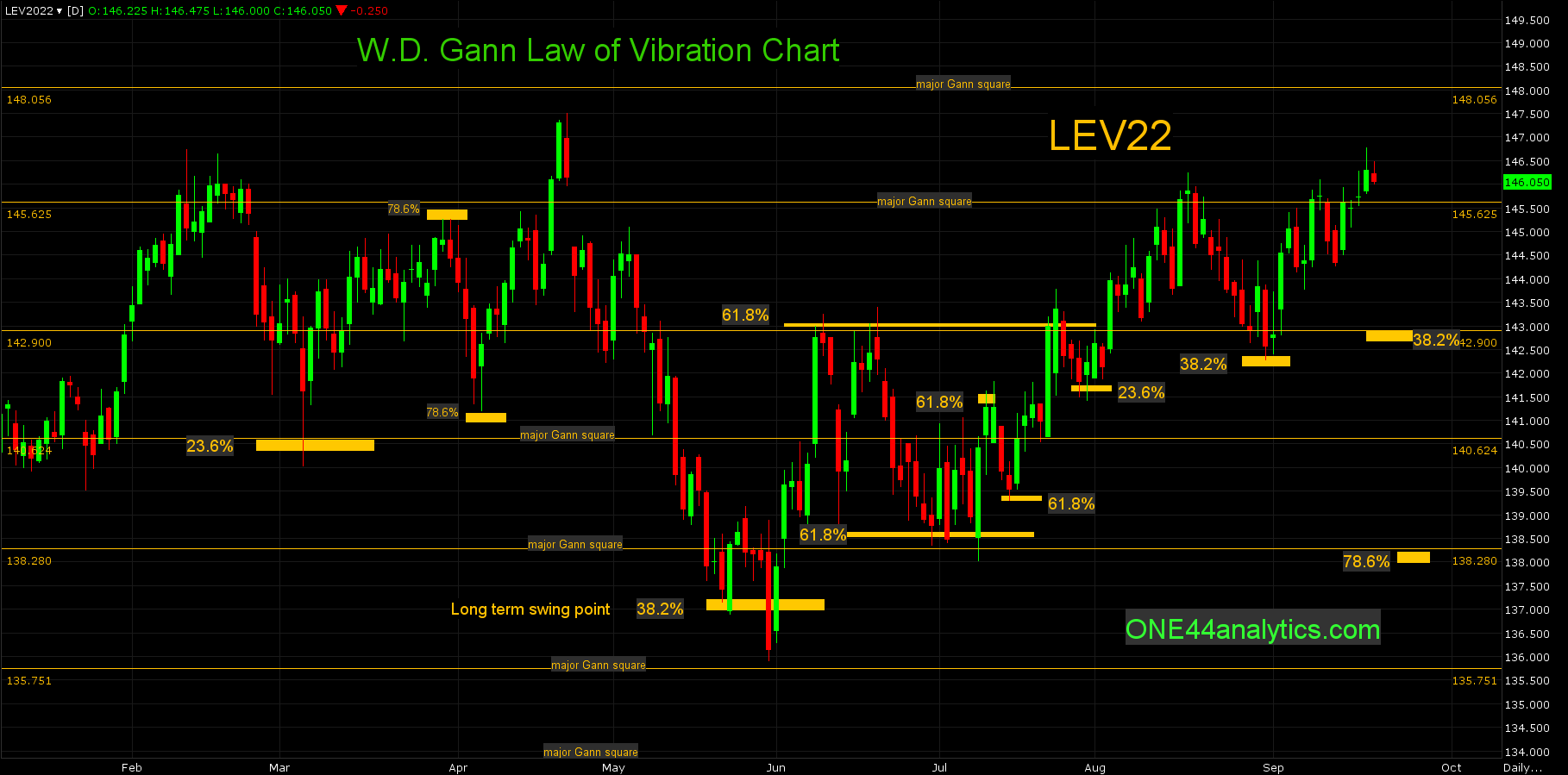

Our long term target on this rally remains at 148.05. Once it can close above the 145.62 major Gann square you can use it as the short term swing point. Above it, look for 148.05. Below it, look for the 142.90 major Gann square.

Yesterday had a solid close above the 145.62 major Gann square. It is now the swing point, with another close above it, look for the next major Gann square at 148.05. With a close back below it, look for 38.2% of the current rally at 142.90, this is also the new 38.2% level going back to the 5/31/22 low, the previous one was 142.35 on 8/31/22.

December Cattle

December has hit the 151.70 major Gann square for the third time this year. Yesterday's trade went above it, but closed below it, This is now the swing point. Below it, look for 38.2% of the rally from the 5/31/22 low, this is 148.30. Back above it, look for the next major Gann square at 156.98.

If you like this kind of analysis and trade the Grains, give us a look Grains Weekly update.

FULL RISK DISCLOSURE: Futures trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Commission Rule 4.41(b)(1)(I) hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under- or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. Past performance is not necessarily indicative of future results.