NASDAQ 100, it's all Fibonacci

NASDAQ 100

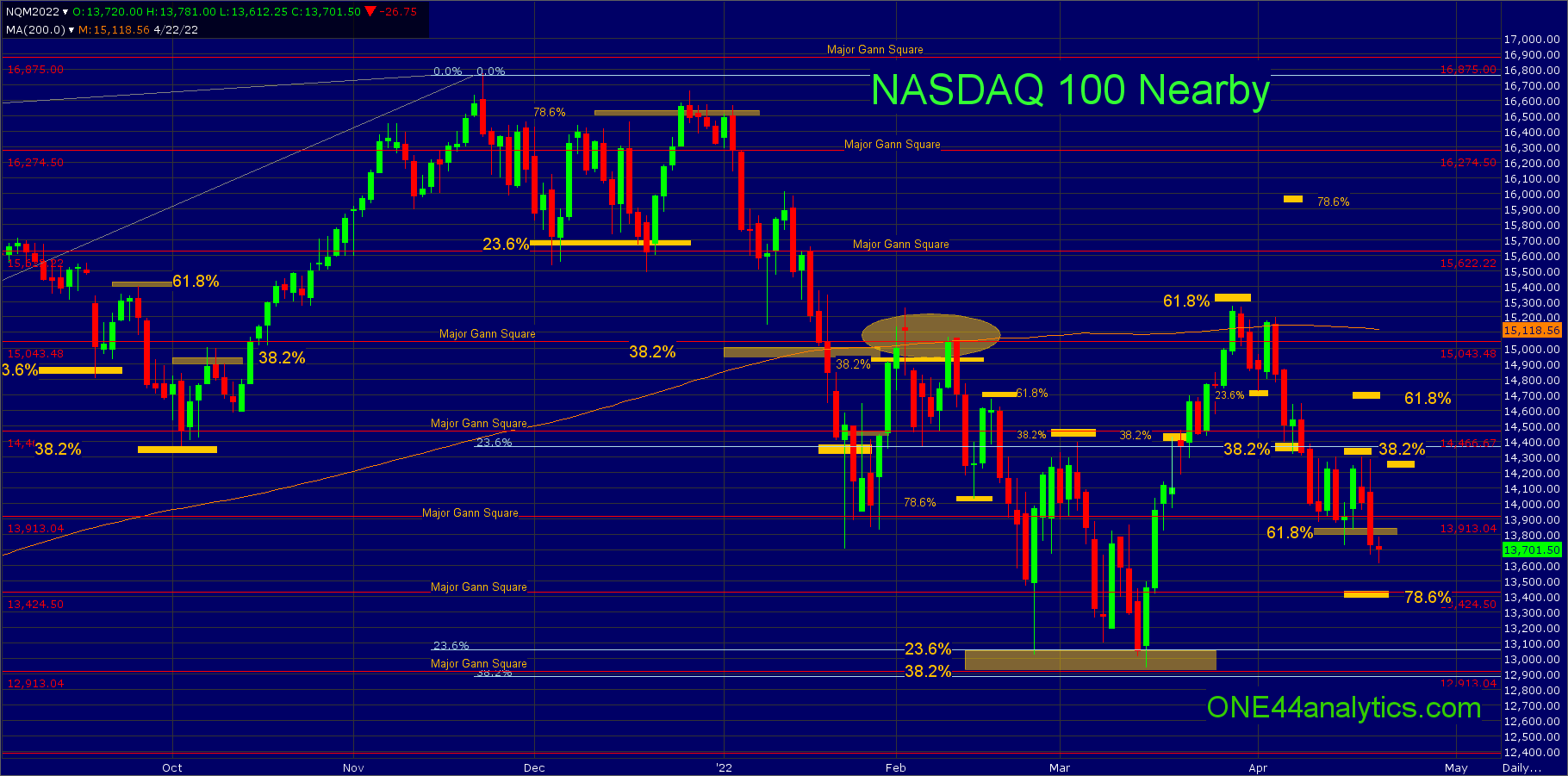

This is an ongoing series of updates on how the Fibonacci retracements with the ONE44 rules and guidelines work in this market and ALL markets.

In our last update on 4/14/22 we left you with this,

As you can see on the chart the 38.2% level at 14,400 produced no bounce, it did hold the area for 3 days, but that was it. The break below 14,400 has now taken it to just short of 61.8% at 13,850, however this is close enough to complete the 61.8% target from 61.8% above based on the ONE44 Fibonacci 61.8% rule. It did hit the 13,913 major Gann square mentioned above and the rally from it was only able to get it up to 23.6% of the current break at 14,200, never a good sign. A rally from 13,850 can send it 61.8% the other way (61.8% rule) and this will be 14,700. Any rally from the current low that can not get above 38.2% at 14,400 keeps the short term trend negative and you should look for new lows. With a close below 13,850, look for 78.6% at 13,424, this is also a major Gann square.

Today

The highs on 4/20/22 and 4/23/22 both could not get above 38.2% at 14,400 keeping the short term trend negative and the new followed. It has now had one close below 13,850 and with another one today, look for 78.6% at 13,424, this is also a major Gann square. Failing to hold the 13,424 area should send them back to the area of 13,000 to 12,850, between these levels is 23.6% back to the 2008 low, 38.2% back to the 2020 low and a major Gann square, below here, stay tuned. Provided they manage a close back above 13,850 today, look for a rally back to 38.2% of the recent break, with today's low this is 14,200.

Sign up for our Free newsletter here.