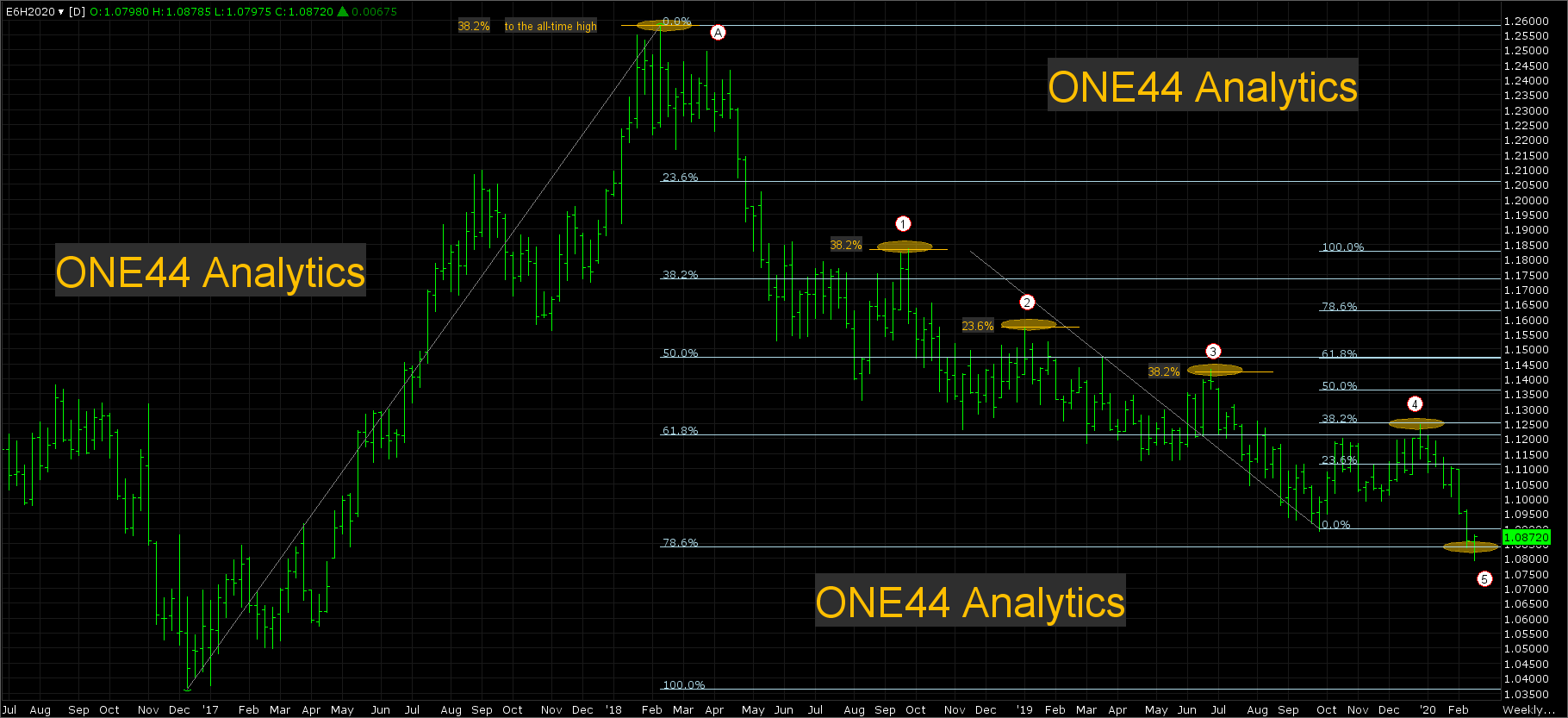

ONE44, Euro bottom and Fibonnaci

Euro

We think the two year bear market is over in the Euro and here's why. The best way to follow this is with the chart below. This break started in Feb. 2018 from 38.2% back from the all-time high (A). From there each attempt to rally was stopped by 38.2%, or 23.6% and the rules for these two retracements are that "they should go for new lows", which they did. The first one came in Sept. 2018 (1) hitting 38.2% back to the high, the second one came in Jan. 2019, this was 23.6% (2) back to the Feb 2018 high. The third attempt to rally came in June 2019 this time it was only able to get back to 38.2% (3) to the Sept. 2018 high and the fourth rally was also only able to get back to 38.2% (4) of the same high. Now that they have made a new low again from a 38.2% retracement we still have to go out further in time to see what kind of retracements are coming up and in this case, they have now hit 78.6% (5) of the Dec. 2016 low and the Feb. 2018 high. The target from 78.6% is for it to go 78.6% the other way, this can take months and even years to complete, but this is why we think the break is over, if they can get a solid close back above the old low of 1.0890 we think the low should be in and the risk to be long is the recent low. The first target with this happening is 23.6% back to the Feb 2018 high, this level is 1.1225. We will be wrong about a bottom happening, if they get a couple closes below 78.6% at 1.0838 and if so look for them to take out the Dec 2016 low.

You can find all the Fibonacci rule/guidelines and examples at www.one44analytics.com